Statement of the V4 Countries

The European Union has set ambitious green targets in all economic areas, including transport. In this regard, the following targets are of special importance: carbon neutrality by 2050, the reduction of greenhouse gases (GHG) by 55% by 2030, producing 40% of energy from renewable sources by 2030 and other specific targets for transport. In order to at least approach those targets, there are some tools in use to support various energy sources, including biofuels. One of the effective tools is the fiscal one: the level of taxation on various energy sources as decided by national governments. It promotes certain energy sources in transport and ensures financial revenues for the state.

The European Union introduced harmonized rules in energy taxation by issuing the Energy Taxation Directive in 2003 (ETD) . It has the following key components:

- Setting minimum taxation level for energy sources, including petrol and diesel, as based on volume (petrol: EUR 359/ 1,000 litres; diesel: EUR 300 /1,000 litres)

- Enabling various taxation levels for various energy products

- Allowing biogenic energy to be exempted from taxation

The V4 countries transposed the ETD into their national law, and in the four countries the common features are as follows:

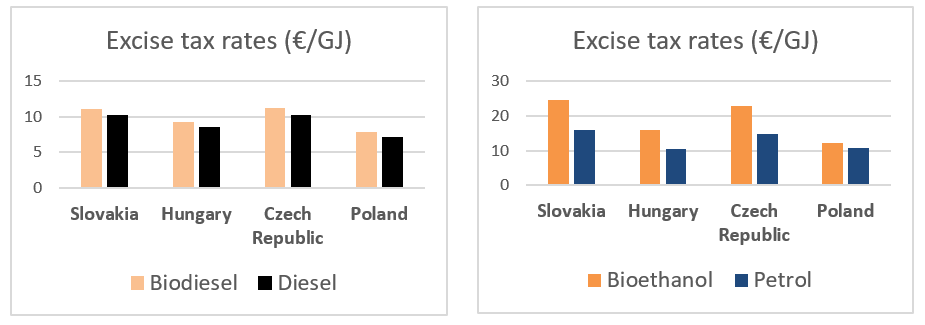

There is a tax rate for diesel and another one for petrol. There is no distinction in tax rates depending on the biogenic content of fuels. None of the tax rates are based on the opportunities the ETD has made available even though they would significantly promote higher biofuel blends (that would mean significantly lower or a zero tax rate for biofuels). The current energy taxation system of the V4 countries only pursues one main goal: to ensure sufficient revenue for the state budget but it fails considering the environmental impact of fossil fuels.

If we recalculate the tax rates as based on energy content, the conclusion is alarming. In all V4 countries the most taxed energy source is bioethanol. Moreover, biodiesel is taxed more than its fossil counterpart, diesel. All that effectively prevents an affordable, rapid and cost-effective transport decarbonisation.

The challenge for regulators in the CEE countries is clear. There is a remarkable example how provisions of the ETD can already be utilized on a national level without waiting for the expected revision of the ETD, which is expected to base taxation on energy or carbon content in the future. French legislators have adopted a substantially lower tax on biofuel components of final fuels, and in France that has created a market for high biofuel blends (E85). That happened in response to calls from industry and consumers without government intervention.

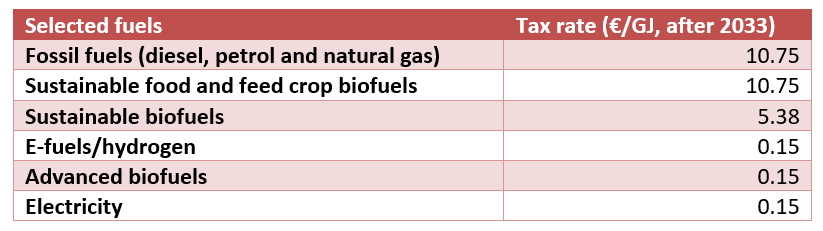

The European Commission – as part of the Fit for 55 package – has recently proposed a revision of the ETD. At last, the proposal acknowledges the need to move from volume-based taxation to energy basis, thereby allowing for prices to better reflect the impact on the environment and the climate. Another part of the proposal is less laudable though, whereby fuel categories are created. The EC proposes the following tax rates for transport fuels:

Needless to say, taxing sustainable crop biofuels by the same rate as fossil fuels will hamper transport decarbonization. Furthermore, before the new tax rates become law, we should get an explanation of the exact meaning of terms like “sustainable food and feed crop biofuels” as contrasted with “sustainable biofuels”. Especially because the proposed tax rate of the latter category is just half of the sustainable crop biofuels.

The V4 biofuel associations encourage V4 national governments to utilize the current provisions of the ETD and follow the French example. In France setting zero taxation for some biofuel blends has enabled a rapid, cost effective and market-driven transport decarbonisation as based on local raw-material sources and local industries. Regarding the proposal to revise the ETD, a shift to energy-based taxation would be welcome but the categorization of fuels should be based on real GHG emissions.

December 2021